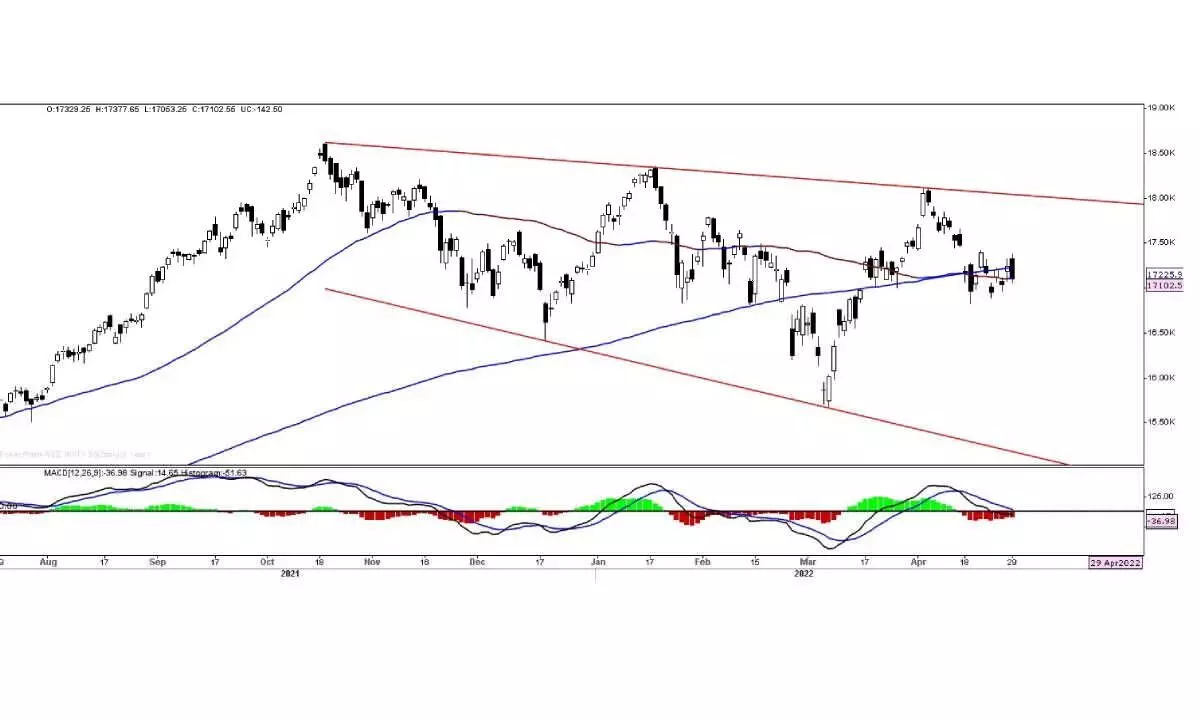

Close below 17k will lead to market downside movement

In the late afternoon session, the domestic equity market crashed with all-round selling pressure. The Nifty declined by 142.50 points or 0.83 per cent. The Media index is the top loser with 2.87 per cent.

image for illustrative purpose

In the late afternoon session, the domestic equity market crashed with all-round selling pressure. The Nifty declined by 142.50 points or 0.83 per cent. The Media index is the top loser with 2.87 per cent. Banknifty is down by 0.92 per cent, and FinNifty is lower by 0.46 per cent. Auto, Realty, Infra, PSU Bank indices declined by over one per cent. The broader indices, the Nifty Smallcap-100 and Midcap-100, were down by 1.16 per cent and 0.84 per cent, respectively. The market breadth is negative as 1,354 declines and 705 advances were recorded. About 47 stocks hit a new 52-week high, and 91 stocks traded in the lower circuit. Adani Wilmar, Axis bank and Reliance were the top trading counters on Friday.

The front line and sector indices once again witnessed a flash crash in the afternoon session. All the sectoral indices were trading with decent gains in the opening session. In the last 90 minutes of trading, the Nifty declined over 300 points in a sharp sell-off. The Banknifty declined over 700 points in just one hour. With this, the positive sentiments have vanished, and the Nifty formed a bearish engulfing candle. At the same time, it closed below the 50 and 200DMAs. For the last ten trading sessions, the index is just oscillating around these two key moving averages. For a third consecutive session, the Nifty registered a negative close. The only positive factor is that it closed above the weekly opening. Even after two successive efforts to close above the 20-week average, it failed. The Nifty has formed a shooting star kind of a candle. As it traded within the previous week's range, the outcomes of shooting stars may not be effective. Today's candle is the second big bearish candle in the last ten days of consolidation. The current counter-trend is in a pennant pattern. As the Nifty failed to fill the 18th April gap or at least a minor high above the 17,414. For the last weeks, the weekly MACD line has been struggling to move above the signal line. With today's declines, the histogram shows that the bearish momentum has increased. The daily RSI was below the 50DMA. The Nifty also closed below the Anchored VWAP. There is very little chance of continuing the consolidation. A close below the day's low of 17,053, will lead to another leg of downside movement. As stated earlier, it is not a time for fresh purchases in the market.

(The author is financial journalist, technical analyst, family fund manager)